Parking your emergency fund or short-term savings in a bank paying 0.01% interest is leaving money on the table. High-yield savings accounts from online banks offer rates 40 to 50 times higher without requiring you to lock up your money or take any additional risk. The question is which one offers the best combination of rate, features, and reliability.

Current Rate Landscape

As of early 2026, competitive high-yield savings accounts are offering around 4.00% to 4.50% APY. These rates fluctuate based on Federal Reserve policy – when the Fed raises rates, savings rates tend to increase. When the Fed cuts, rates drop. But even in lower rate environments, online banks pay significantly more than traditional brick-and-mortar banks.

Traditional banks can get away with paying almost nothing because customers maintain accounts for convenience despite terrible rates. Online banks need to compete on rate because that’s their primary value proposition. No branch network means lower overhead, which they pass along as higher interest rates.

The rate difference matters substantially. $10,000 in a savings account at 0.01% earns $1 annually. That same $10,000 at 4.25% earns $425 annually. Over five years, the difference is $2,100 versus $5. You’re quite literally giving away thousands by accepting low rates.

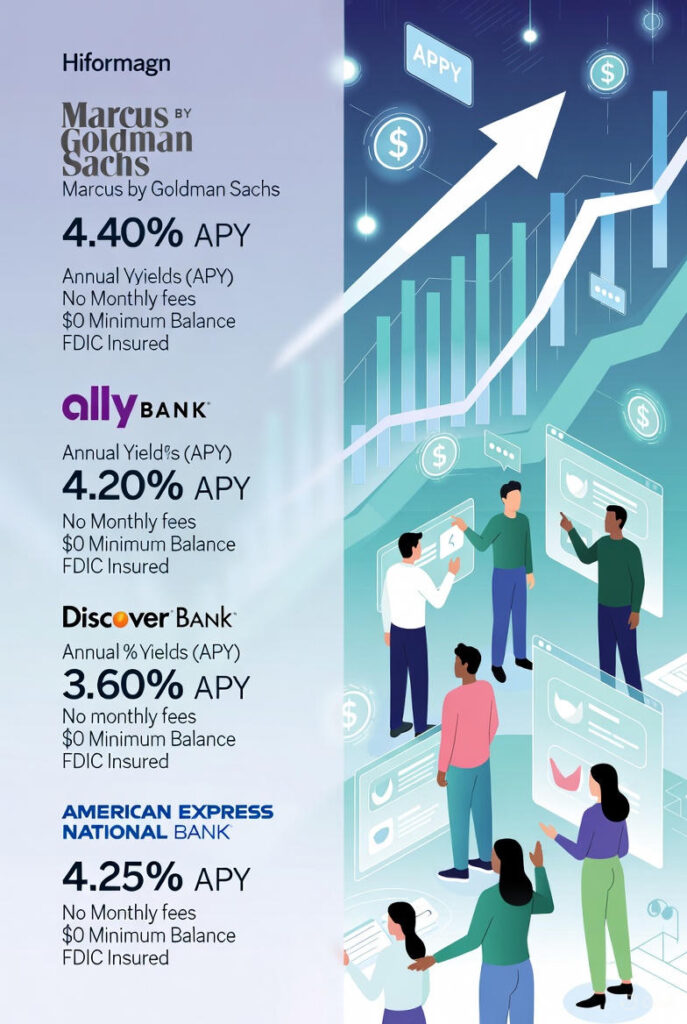

Marcus by Goldman Sachs

Marcus launched as Goldman Sachs’ consumer banking arm, bringing the Wall Street firm into everyday banking. The savings account typically offers competitive rates, currently around 4.40% APY with no minimum balance requirement and no monthly fees.

The appeal of Marcus is simplicity. It’s a straightforward savings account without complicated fee structures or requirements. You open it, transfer money in, and earn interest. The interface is clean and easy to navigate. No surprises or gotchas in the fine print.

Customer service gets consistently positive reviews. Phone support is available and generally helpful. The website and mobile app work reliably. For people who want a no-drama place to park emergency funds, Marcus delivers.

The main limitation is Marcus doesn’t offer checking accounts, so you can’t have all your banking in one place. Transfers between Marcus and external banks typically take 1-3 business days. This isn’t a problem for emergency fund storage where instant access isn’t critical, but it means Marcus won’t be your only bank.

Marcus raised rates relatively quickly when the Fed increased rates but tends to be slower reducing rates when the Fed cuts. This benefits savers during rate decline periods but means you might not get the absolute highest rate during rising rate environments.

Ally Bank

Ally evolved from GMAC, the old auto finance company, into a full-service online bank. Their savings account currently offers around 4.25% APY with no minimum balance and no monthly fees.

What distinguishes Ally is the complete banking ecosystem. They offer checking accounts, money market accounts, CDs, investment accounts, and even auto loans. If you want to consolidate your financial life with one institution, Ally provides that option.

The checking account integration is particularly useful. You can have both checking and savings at Ally and transfer between them instantly. The checking account includes a debit card, bill pay, and mobile check deposit. This makes Ally viable as your primary bank rather than just a savings account add-on.

Ally’s interface shows its age slightly compared to newer fintech apps, but it’s functional and comprehensive. The mobile app handles all standard banking tasks competently. Customer service is available 24/7 by phone, which matters when you have urgent banking needs outside business hours.

Overdraft protection features are more consumer-friendly than many banks. Ally won’t charge overdraft fees if you overdraw by less than $50, and you have until midnight the next business day to cover negative balances without fees. Small detail, but it reflects a generally customer-friendly approach.

The downside is Ally’s rates aren’t always the absolute highest available. They’re competitive but not always leading. If maximizing every basis point of interest matters to you, you might find higher rates elsewhere. If convenience and full banking services matter more, Ally’s rate is good enough.

Discover Bank

Yes, the credit card company also offers banking products. Discover’s savings account currently offers around 4.30% APY with no minimum balance and no fees.

Discover has name recognition and a long history, which provides comfort for people nervous about newer online banks. They’ve been around since the 1980s, are FDIC insured like all these options, and have substantial financial stability.

The cashback checking account is an interesting feature. Earn 1% cash back on up to $3,000 in debit card purchases monthly. This isn’t a huge amount – maximum $30 monthly – but it’s unusual for checking accounts to offer any rewards. Combined with the high-yield savings account, Discover provides a complete banking package with better returns than traditional banks.

Customer service is available 24/7 and generally gets positive reviews. The mobile app is solid and regularly updated. No monthly fees or minimum balance requirements on savings or checking accounts keep things simple.

Discover’s weakness is foreign transaction fees if you travel internationally. The debit card charges 1% on international purchases plus ATM fees. If you travel abroad frequently, this is inconvenient. For domestic use, it’s a non-issue.

The savings account rate has historically been competitive but not always the absolute highest. Discover seems to target being in the top tier rather than racing to have the highest rate at any given moment. This creates stability – your rate doesn’t fluctuate as much – but you might miss out on slightly better rates elsewhere.

American Express Personal Savings

American Express, another credit card giant, offers a high-yield savings account currently around 4.25% APY with no minimum balance and no fees.

Amex’s savings account is dead simple. It’s just a savings account with a good rate. No checking, no debit card, no bill pay – just interest on your balance. This simplicity is either perfect or limiting depending on what you need.

Opening an account is fast, usually approved within minutes if you have decent credit. The interface is clean and modern. Transfers to and from external banks process quickly, usually within 1-2 business days.

American Express has substantial brand recognition and financial stability. For people who want their savings at an established institution rather than a newer fintech, Amex provides that comfort.

The limitation is exactly what makes it simple – it’s only a savings account. You’ll need banking services elsewhere for everyday transactions. American Express clearly designed this as a place to park savings, not as a complete banking solution.

Customer service is available by phone and generally responsive. The mobile app is straightforward for checking balances and transferring money but obviously doesn’t have the features of a full banking app since there’s less to manage.

Amex tends to be very responsive with rate changes. When the Fed raises rates, Amex usually increases savings rates quickly. When rates drop, they also decrease quickly. This cuts both ways – you get increases fast but also decreases fast.

Making the Choice

If you want a complete banking solution with checking and savings in one place, Ally makes the most sense. The rate is competitive enough, and the convenience of having everything integrated outweighs chasing an extra 0.10% APY elsewhere.

If you want the simplest, no-frills high-yield savings account and don’t care about other banking features, Marcus or American Express are solid choices. Both offer competitive rates with straightforward terms and no surprises.

If you like the idea of cashback on debit card purchases and want a hybrid approach, Discover provides that unique feature combination. The rewards checking plus high-yield savings creates a complete package with slightly better returns than pure savings alone.

The rate difference between these options is usually minimal – maybe 0.10% to 0.20% APY. On a $10,000 balance, that’s $10 to $20 annually. Not nothing, but probably not worth obsessing over if one platform offers features or convenience you value.

All four institutions are FDIC insured up to $250,000 per depositor. Your money is equally safe regardless of which you choose. The differences come down to rates, features, and which interface you prefer using.

Many people use multiple banks. Keep your emergency fund at whichever has the highest rate. Use a different bank for checking and daily transactions. There’s no rule saying all your money needs to be at one institution. Optimizing different accounts for different purposes often makes more sense than trying to find one perfect bank for everything.

The most important decision is moving money out of accounts paying nothing. Whether you choose Marcus, Ally, Discover, or Amex matters much less than choosing any high-yield savings account over a traditional bank paying 0.01%. That decision alone makes you hundreds or thousands of dollars annually depending on your balance.