For decades, the path seemed obvious. You had an idea, you built a prototype, you pitched venture capitalists, you raised a seed round, you hired a team. Growth meant headcount. Scale required capital. Success was measured by how much money you could raise and how fast you could burn through it chasing user numbers.

That playbook worked brilliantly for VCs and the handful of founders who timed everything perfectly and rode their companies to acquisitions or IPOs. For everyone else – which is most entrepreneurs – it meant giving up massive chunks of equity, enduring board meetings where investors questioned every decision, pivoting based on what would look good in the next fundraising deck rather than what made business sense, and often ending up with nothing when the money ran out before profitability materialized.

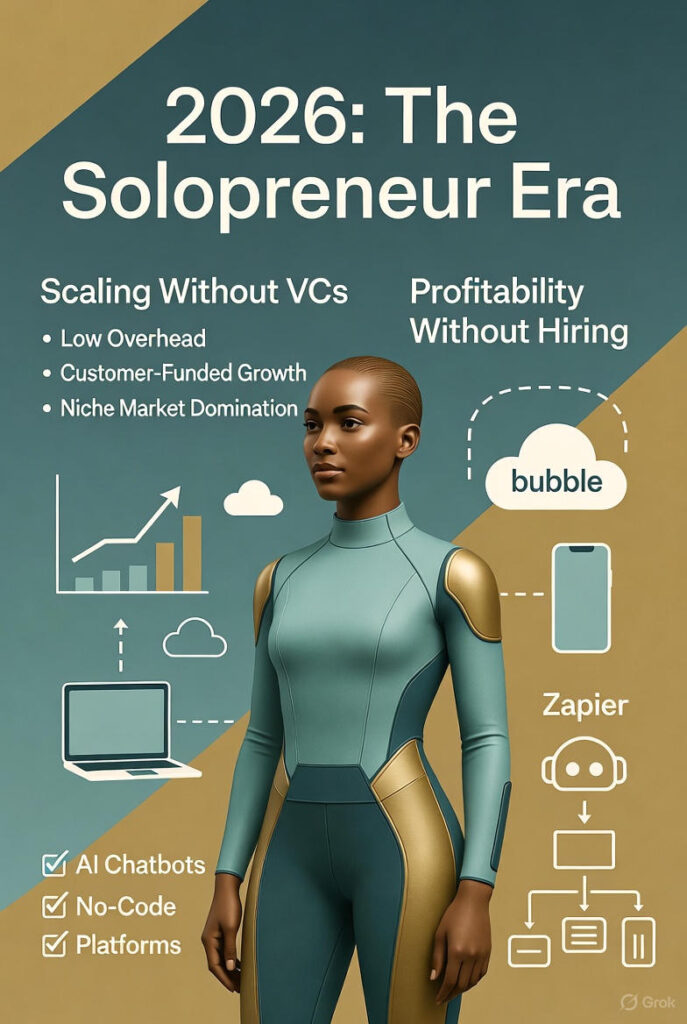

Something shifted over the past few years, accelerating dramatically in 2025 and into 2026. The equation changed. The tools got good enough that the old rules stopped applying to a huge category of businesses. A solo founder sitting in a coffee shop in Austin or a spare bedroom in Portland can now build and run operations that would have required a team of fifteen people just five years ago.

The new math is straightforward and a bit shocking when you run the numbers. Maximum value, minimum team. Or more accurately, maximum profit, zero team.

When Time Stopped Being the Bottleneck

Venture capital historically solved one problem really well: it bought time by converting it into specialized labor. You needed a feature built? Hire a developer for $120k annually. You needed marketing campaigns? Bring on a marketing specialist for $80k plus benefits. Customer service scaling? Add support staff. Each problem got solved by throwing salary at it.

This made sense when building software required actual programming knowledge, when marketing meant buying ads and hoping they worked, when customer service meant humans answering phones. The constraint was time – specifically, the founder’s time – and VC money let you buy other people’s time to remove yourself as the bottleneck.

No-code platforms and AI automation have broken that constraint entirely. The bottleneck isn’t time anymore. It’s knowing which tools to use and how to configure them properly.

Platforms like Bubble let non-technical founders build genuinely complex web applications. Not simple landing pages – actual software with user authentication, databases, payment processing, custom workflows. A booking system that would have required hiring a developer for three months can be built by a founder in a weekend after learning the platform. The learning curve exists, but it’s measured in days or weeks, not years of computer science education.

AI-powered builders have taken this even further. Tools like Lovable or Base44 let you describe what you want to build conversationally, and they generate functional applications. You’re essentially chatting with an AI that understands software architecture well enough to translate your business requirements into working code. The output needs refinement and human judgment, but the heavy lifting of turning ideas into functional software has been dramatically compressed.

For the administrative and operational side, automation tools like Zapier and Make have become the connective tissue that lets one person manage systems that used to require dedicated staff. A lead fills out a form on your website. That data automatically flows into your CRM, triggers a welcome email sequence, creates a task in your project management system, logs the interaction in your database, and schedules a follow-up reminder. Zero human intervention required, zero errors from manual data entry, zero time spent on coordination.

The solopreneur stops being the bottleneck because the repetitive work happens automatically while they focus on the high-value activities that only they can do – strategy, key relationships, creative decisions, product direction.

The $10k Monthly Stack

Most solo founders aren’t trying to build the next Facebook. They’re trying to build a business that generates $10,000 to $30,000 in monthly revenue with profit margins around 80-90%. That level of income, sustained and growing steadily, provides an excellent living while maintaining complete control and minimal stress.

The cost structure makes this possible. Where a traditional startup might spend $15,000 monthly on salaries for a minimal team – a developer, a marketing person, an admin – a solopreneur might spend under $400 monthly on software subscriptions that handle the same functions.

A sales assistant earning $4,000 monthly gets replaced by ActiveCampaign plus some AI tools for around $80. A junior developer at $6,000 monthly gets replaced by Bubble or Webflow at $100. An executive assistant at $5,000 monthly gets replaced by Zapier and an AI agent for maybe $200. The cost reduction isn’t incremental – it’s a 97% decrease in overhead.

This matters enormously for unit economics. A service business that charges $2,000 for a deliverable and has $400 in monthly fixed costs can be profitable after a handful of clients. The same business structured traditionally with $15,000 in monthly payroll needs eight clients just to break even before the founder takes any salary.

Low overhead means you can price competitively, reinvest profits immediately into growth, weather slow months without panic, and achieve what’s called customer-funded growth. You don’t need VC money because your early customers fund your expansion. Each sale pays for itself and contributes to building the next capability.

Venture capital only makes sense if it buys you speed that matters competitively. If you’re in a winner-take-all market where being second means being worthless, then yes, raise money and outpace competitors. But most businesses don’t operate in winner-take-all markets. They operate in niches where being good, reliable, and profitable beats being big and fast. A solo founder building a specialized project management tool for architects doesn’t need to raise $5 million because there’s no race to capture market share before competitors do.

From Idea to Revenue in Weeks, Not Years

The traditional startup timeline was brutal. Six months to build an MVP. Another six months to get early traction. A year trying to fundraise. More months hiring and onboarding. You could easily burn two years before having a real business with actual revenue and a path to profitability. Many companies died in this valley between starting and becoming sustainable.

The modern solopreneur path compresses this dramatically by prioritizing validation and revenue over perfection and scale.

Start by identifying a specific, painful problem in a niche market. Not “people need better project management” which is too broad, but something like “financial advisors need an easier way to track and share client documentation with compliance requirements.” The narrower and more specific, the better, because you can actually solve it completely rather than building a general-purpose tool that’s mediocre at everything.

Build the MVP in days, not months. Use a no-code platform to turn a Google Sheet or Airtable base into a functional app. It doesn’t need to be beautiful or feature-complete. It needs to solve the core problem well enough that someone will pay for it. Glide can turn a spreadsheet into a mobile app in hours. Webflow can build a sophisticated website in a few days. Softr can create a customer portal or booking system over a weekend.

The key insight is launching before you’re comfortable with it. Traditional startups hid in development for months, terrified of showing imperfect products. Solopreneurs ship fast, get real users immediately, and improve based on actual feedback rather than assumptions.

Customer-funded growth means finding a small group of early adopters – sometimes called lighthouse clients – who will pay you to solve their problem. These first customers aren’t buying a polished product; they’re buying a solution to a pain point they have right now. They’ll tolerate rough edges if it genuinely helps them. That initial revenue pays for your software stack and gives you runway to refine the product without touching savings or raising capital.

Once you have product-market fit with those first clients, automate everything that doesn’t require human judgment. Use AI chatbots for customer support that can handle common questions and escalate complex issues. Use Zapier to automate billing, invoicing, payment reminders. Use Buffer or similar tools to maintain social media presence without manually posting. Your limited time goes entirely into acquisition – getting more customers – and product strategy – deciding what to build next.

Why This Model Works Now

The market has shifted in ways that favor this approach. Customers, especially in B2B, aren’t necessarily looking for the next unicorn software that does everything. They’re looking for focused, high-quality solutions to specific problems. They’ve been burned by enterprise software that’s bloated, expensive, and terrible to use. A simple, focused tool that solves one thing brilliantly often wins against a complex platform that does a hundred things poorly.

Businesses built this way have structural advantages. They’re highly profitable because overhead is minimal. They’re defensible because they become hyper-specialists in niches where massive VC-funded startups can’t be bothered to compete – the market is too small for venture returns. And they’re lifestyle-oriented, meaning the business serves the founder’s life rather than the founder serving investors’ exit timelines.

Take a real example playing out across hundreds of businesses right now. Someone with deep expertise in a specific industry – say, dental practices – identifies that scheduling and patient communication are handled terribly by existing practice management software. They build a focused tool using no-code platforms that integrates with the practice management systems dentists already use but handles scheduling, reminders, and patient communications much better.

They charge $200 monthly per practice. Their software costs are maybe $300 monthly total. After fifty clients – which is achievable in a year with focused marketing to a defined niche – they’re generating $10,000 monthly revenue with $9,700 profit. They work twenty hours weekly maintaining and improving the product while the systems handle everything else automatically. No employees, no office, no investors asking about growth rates.

That business will never be worth a billion dollars. It will never IPO. It doesn’t need to. It’s generating six-figure profit annually with minimal stress, complete autonomy, and the ability to run from anywhere. For many founders, that’s a better outcome than the venture path.

The Culture is Changing Too

What’s perhaps most interesting is how cultural attitudes around entrepreneurship are shifting. The prestige used to be entirely in the VC-backed startup world. Raising a big round got you press coverage. Having a team of fifty felt like validation. Staying small seemed like you couldn’t compete or lacked ambition.

That’s changing fast. The “lifestyle business” label that used to be vaguely insulting has been reclaimed. Founders are openly proud of building businesses optimized for profit and quality of life rather than growth and exits. There’s a whole community of entrepreneurs sharing revenue numbers, profit margins, and tool stacks publicly, celebrating hitting $50k monthly revenue as a solo founder more than raising a $5 million Series A.

Part of this is founders watching what happened to their peers in the venture game. The 80-hour weeks that became 90-hour weeks. The co-founder disputes that turned nasty. The down rounds where earlier investors got preferences and founders ended up with nothing. The pivots that felt like abandoning your original vision. The shutdowns where years of work evaporated overnight. Even successful exits often left founders burned out and, after dilution and preferences, not particularly wealthy relative to the stress they endured.

The solopreneur path looks sane by comparison. Build something profitable. Keep your equity. Make your own decisions. Take distributions quarterly. Scale at a pace that feels sustainable. It’s entrepreneurship designed for humans rather than for venture return profiles.

Interestingly, some founders who could raise money are deliberately choosing not to. They’ve run the numbers and realized that a $30k monthly profit business they own 100% will likely make them wealthier over ten years than raising money, diluting to 40% ownership, and chasing a growth path that probably fails. The math actually works out that way for most businesses that aren’t winner-take-all markets.

What This Doesn’t Work For

Reality check: this model has clear limits. You cannot build a self-driving car company as a solopreneur. You cannot manufacture pharmaceuticals. You cannot develop commercial real estate. Certain businesses require large teams, regulatory approvals, physical infrastructure, or capital equipment that no amount of automation replaces.

Hardware products usually need funding unless you’re doing very small-scale manufacturing. Marketplaces often need VC to overcome the cold start problem – you need buyers and sellers simultaneously. Some software categories are so competitive that you need to move fast and establish network effects before others do.

But digital products, online education, consulting services, content businesses, niche software tools, specialized services, coaching, creative work, e-commerce (with dropshipping or managed inventory), and tons of other categories fit this model perfectly. The barrier to entry has collapsed while profit potential stayed high or even increased because customers value focused solutions.

The Infrastructure Keeps Improving

Everything around solopreneurs is getting better too. Payment processing is dead simple now – Stripe or similar services handle everything from subscriptions to invoicing with a few clicks. Business formation can happen online in a day. Accounting software like Wave or QuickBooks Self-Employed handles basic bookkeeping automatically. Legal templates for contracts and terms of service are available for reasonable prices. Health insurance marketplaces exist specifically for self-employed individuals.

Even banking is catching up. Some banks offer accounts designed for single-person businesses rather than forcing solopreneurs into small business accounts built for companies with payroll. Better interfaces, lower fees, integrated bookkeeping, easy contractor payments. The boring operational stuff that used to require expertise or employees now gets handled with software and minimal time investment.

The support infrastructure matters because it removes friction. Ten years ago, being a solo business owner meant spending significant time on operational tasks. Now those tasks are either automated or require a few minutes monthly.

Looking Forward

The trend is clear and probably accelerating. More people will realize the traditional VC-backed startup path is one option, not the only option. The solopreneur model offers a legitimate alternative that trades potential maximum outcomes for higher probability of success, growth pressure for profitability, complexity for simplicity, external control for autonomy.

As tools continue improving – and they are improving fast – the range of businesses you can run solo expands. Things that required small teams last year can be done solo this year. Things that need teams now might be solopreneur-friendly in two years.

The new millionaire class of 2026 isn’t necessarily the founders ringing bells at stock exchanges. It’s often the person running a highly profitable micro-business from a laptop, serving a focused market really well, keeping overhead minimal, and banking most of what comes in. Building wealth steadily through sustainable profits rather than swinging for the unlikely home run.

Some of these solopreneur businesses will eventually sell for meaningful multiples to buyers looking for cash-flowing assets. Others will just run indefinitely, providing excellent income and lifestyle flexibility for founders who realize they’ve built exactly what they wanted – a business that serves their life rather than consuming it.